Summer Market Report Update

July metrics show a market that has shifted. Demand in the Denver Metro Area has dipped due to high prices and rising interest rates. As a result, prices have stabilized, and homes are staying on the market a bit longer. While there might be quite a bit of uncertainty in the Denver housing market right now with home sellers and home buyers adjusting to new realities, the good news is that Colorado’s economy is strong.

Are buyers backing out of contracts as a result of market conditions? This July, 12% of listings in Pending status moved back to Active, which is 3% more than we saw last July.

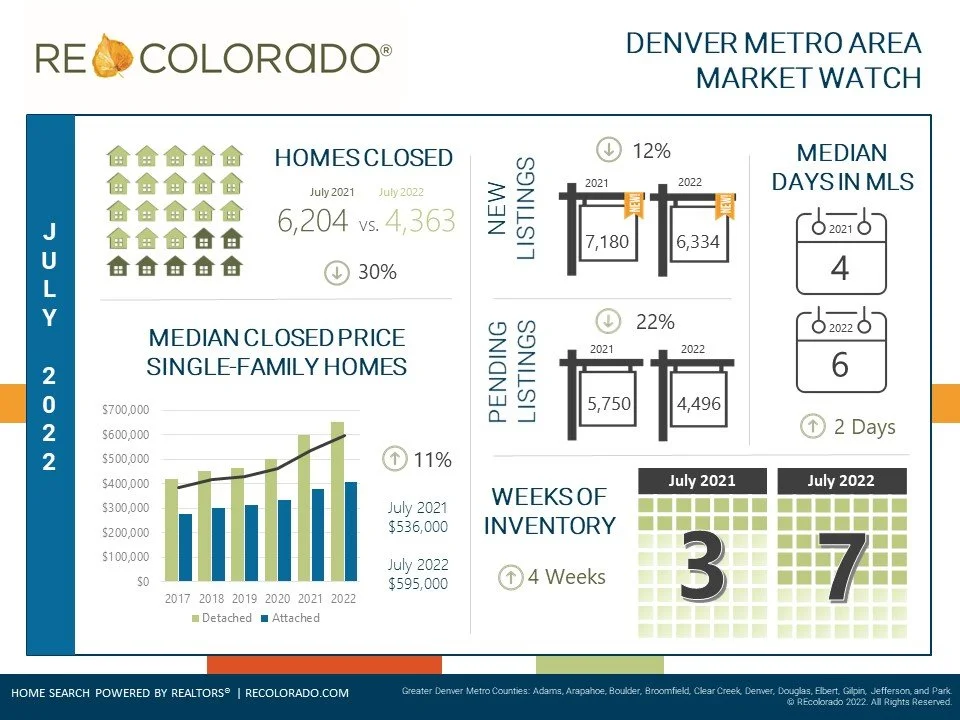

According to REcolorado metrics, July saw a decrease in the number of closings as compared to both last month and last year as home buyers heard the news of rising interest rates. The number of closings was lower than we’ve seen in the month of July since 2011.

Price appreciation has continued to slow in the face of rising mortgage rates. In July, the median price of homes was 11% higher than last year. However, from a month-to-month perspective, prices are tapering with July bringing the third consecutive month of declines in the median price of a closed home. According to REcolorado data, 4% of listings saw a price decrease from the original list price, which is the same as July 2021.

https://www.recolorado.com/

The median number of days it took a listing to move from actively available in the REcolorado MLS to the Pending status crept up in July. With more inventory on the market and less competition, buyers have more time to make decisions. Still, more than half of available homes have a contract written on them in less than a week.

The number of new listings sellers brought to the market decreased from last July as well as last month. The market typically sees a decrease in new listings from June to July due to the July 4th holiday and summer vacations. However, this is the lowest number of number of new listings we’ve seen in the month of July since 2021.

Buyer activity pulled back for the second consecutive month as home buyers reevaluated their finances given today’s home prices and higher interest rates. As a result, the number of pending listings, a leading indicator that is used to predict closings in the next month to two months, saw declines from last year and last month. Similar to new listings, it is typical to see a dip in buyer activity in July due to the long July 4th weekend and vacation schedules.

July saw a decrease in the number of closings by price range with the exception ofthe $2M+ category where we saw a 19% increase. The number of New Listings that came on the market increased in the ranges of $600,000 and more. Properties priced below the $600,000 mark saw decreases in listings. There were 25% more listings brought to the market priced $2M and above than in July of 2021.